Eagleview - Onsite

Enabling insurance teams to close hail damage claims without leaving the office.

⚠️ Under A non-disclosure agreement

Some of the details in this case study may be vague or recreated to protect intellectual property.

Context

Eagleview is an aerial photography company with a stronghold in the roof measurement business. We fly small airplanes all over the US and Canada capturing billions of photographs that can be used to measure roof and siding of a structure (among other things). We have customers in construction, government, insurance, solar and utilities.

On a day like any other, I walked past a conference room when I heard some whispers. It sounded like something secret was happening. So after too much lurking, I poked my head in and made my way into the conversation. It was me and five others: an engineering lead, a product manager, a data analyst, product marketing manager and sales lead for insurance.

There was a new RFP from Allstate Insurance and our leadership team thought we had a pretty good play for it. Allstate was trying to update antiquated workflows by replacing people climbing on roofs with drone imagery after hail events.

Business opportunity

In 2017, 10.7 million U.S. properties were affected by a damaging hail event, resulting in losses of more than $13 billion for Insurance companies.

Our opportunity was an $35 million RFP with Allstate insurance.

Research

Understanding the user journey

My first step was to understand the people. I interviewed subject matter experts and adjusters to get the full picture of their job and all its intricacies. Discovery was constant and ran parallel to design–experimenting and improving weekly.

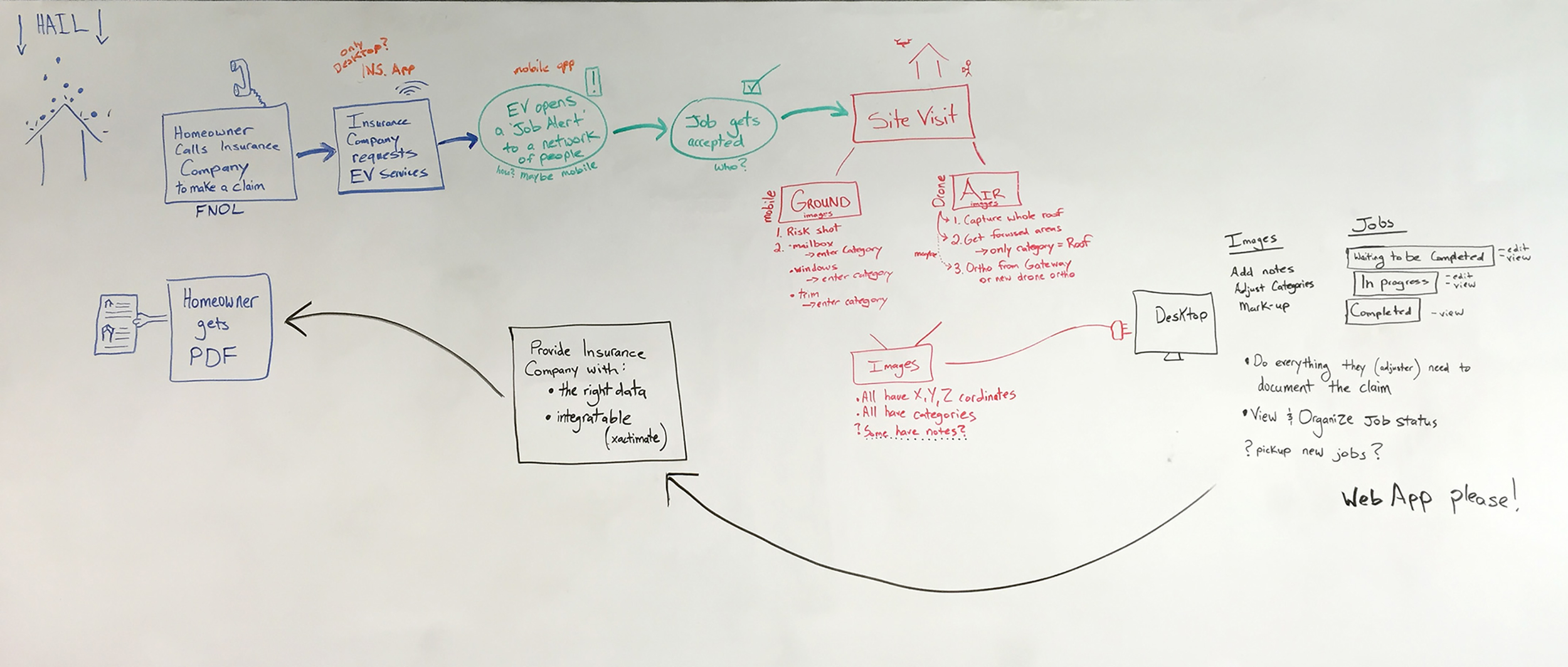

To align the team on our on our plan, I put together a user journey to see if I was understanding everything correctly and to see where we could make changes/updates.

User problems/needs:

There’s often no cell service when visiting a home.

Photos of no damage are just as important! To prove non-damage from that storm. “I take more photo’s when there is less damage.”

For each home, first verify its hail damage with 100% certainty, then start to figure out what you need to replace.

If the roof pitch is over 6/12, they hire a ladder assist professional to do that roof (twice the cost as in-house adjusters).

Everything is documented in a map like the one pictured here and in the form of notes, detailing out every side of every structure. They call these scope notes. “Scope notes tell the story. Photos prove the story.”

Our Strengths

We already provide insurance companies with roof and siding measurements reports which they need for each home.

We have a great reputation for producing accurate measurements from photographs.

We have a strong network of partners.

A Day in The Life

I put together “A Day in the Life” story’s that helped me build empathy for the insurance team and to understand what users would need to close a hail damage on a regular day. I used those story’s to write technical specifications with my product manager on what users would need to make the same claim without visiting the home.

We regularly went back and forth with our users on these details ensuring the new solution could indeed replace the in person activities.

Ideate

There were a lot of ideas and potential software solutions we could build, but one that was critical to the success of this project. It was a web application that would substitute the adjusters site visit, allowing them to instead review each claim remotely - as if they are there.

Referencing my recently finished user persona’s hanging right behind my desk, I white boarding ideas.

Test

Round One

Once I had synthesized all the parts into a lightweight wireframe, it was time test it on actual users. I turned these low fidelity wireframes into a prototype, and conducted usability testing with three insurance adjusters.

Priority

Is there enough data to close a hail damage claim remotely?

Does this workflow make sense? How could it be better?

What data needs to go where after reviewing these images and notes?

What concerns are there? What is missing?

Are there additional downfalls to receiving data from a 3rd party drone pilot?

Behind the Scenes 🎬

This first round of testing turned out to be a major bonus to the project, but it received significant push back early-on.

Some old-school Balsamiq prototypes 👆

These worked awesome, correcting high-level assumptions about image organization and improving workflow steps that I would’ve been more difficult to learn with higher-fidelity prototypes.

Testing round 2

There was a second round of testing as I raised the fidelity.

These were conducted with working software on-site with adjusters.

I emphasized the round one testing because it was more critical to the success of this project.

Have you ever seen Twister?

Independent adjusters are kind like Tornado chasers, making their living following hail storms around the Texas pan handle in March–and quite often doing their work in hotel rooms.

The first hail storm

Working with the VP of Product and VP of Sales, I helped make a lot of decisions that weren’t software related.

For example, we had to decide what homes to test this on in March, when the first hail storms typically came.

The homes in the center of the storm usually have the most damage, which makes it easier for the insurance company to say replace the whole thing versus a repair decision. The site visit becomes more of a documentation of the damage with the homeowner receiving payment for a full loss 98 percent of the time.

The image here shows a typical storm path visualization. We decided to test this project at homes that experienced hail at a size of two inches or greater.

Our first release

A web application that looks a lot like a Adobe Lightroom or Adobe bridge.

The images from this home are displayed in a long scroll on the left column, the selected image is outlined in yellow in the middle and a top-down diagram of the property on the right side.

The claims adjuster can perform a virtual walk-a-round of the property, just as they previously did in person.

The images are organized by structure and elevation (roof or walls); perfect for understanding the full claim while remote.

Annotations

The claims adjuster can annotate each image, add notes and the number of strikes in an area from this page.

With that functionality they were able to close the hail damage claims exactly as they have in the past except without visiting the property.

Full access to measurements

With one click, remote adjusters can locate measurements reports of the entire property and turn repair/replace decisions into specific numbers for the homeowner.

Improving

UI and AI

I continued to refine the UI from learnings and feedback from users that year.

We added machine learning algorithms to automatically mark hail strikes and differentiate from other anomalies (like ball point hammer strikes for example). I worked with the AI team we acquired, but this feature was implemented after I left the company.

Mobile

I made mobile workflows for our second push to help our field adjusters with scheduling and streamlined mobile upload.

We Won the RFP!

I combined imagery from multiple sources, including fixed wing aircraft and drones, to enable insurance adjusters to inspect properties without leaving the office. This led to a $35m RFP win for Eagleview.

Allstates measured success in three ways– safer, cheaper, faster.

Policy holders received payments for losses, on average, 3 days faster (30-40 percent) with our new solution.

Allstate increased adjuster efficiency by 50-60 percent, saving in billions in annual employee costs.

We saved lives! There were 20 percent less deaths from adjusters falling off roofs the following year (2019) and a 45 percent reduction in injury.

This collaboration led to Allstate winning the Novarica Impact Award in 2018.

I was grateful that my 1st project was a large, high stakes one. I learned a lot about working in teams and leading large projects and keeping users at the center of my work.